In the 2019 document “The Future of Hydrogen”, prepared by the International Energy Agency (IEA) for the G20 meeting, it was stated the following:

“All energy carriers, including fossil fuels, encounter efficiency losses each time they are produced, converted or used. In the case of hydrogen, these losses can accumulate across different steps in the value chain. After converting electricity to hydrogen, shipping it and storing it, then converting it back to electricity in a fuel cell, the delivered energy can be below 30% of what was in the initial electricity input. This makes hydrogen more “expensive” than electricity or the natural gas used to produce it. It also makes a case for minimising the number of conversions between energy carriers in any value chain. That said, in the absence of constraints to energy supply, and as long as CO2 emissions are valued, efficiency can be largely a matter of economics, to be considered at the level of the whole value chain. This is important as hydrogen can be used with much higher efficiency in certain applications and has the potential to be produced without greenhouse gas emissions.”

In the 2021 version “Global Hydrogen Review”, the IEA recognized in its policy recommendations that “current carbon prices are not high enough to close the cost gap between low carbon hydrogen and fossil based alternatives”, thereby considering the imposition of hydrogen mandates, quotas and public procurement processes conditioned on the use of hydrogen, beyond using dramatically higher carbon prices which usually range between US$ 5 and US$ 25 per ton of CO₂ worldwide, with the exception of the EU that has been pushing it beyond US$ 60 per ton of CO₂ in present days.

What is the point? Green hydrogen is much more expensive to obtain than fossil based ones, particularly natural gas. As a consequence, for the world to adopt it there needs to be implemented a globally coordinated taxation on its fossil based alternatives and across all countries, with cost consequences mainly ignored by most people. Everybody would agree to the idea of living in a clean environment with less greenhouse gases, for free. It is a quite different case when you need to pay for it, in coordination with all the others to make it work.

Would people easily agree to paying twice for electricity and heating at home or for using their car to accomplish this purpose? Would all people, across all countries, contribute?

What we are witnessing is the attempt to create a huge industry essentially dependent on active public policies coordinated across the world. In the “Net Zero by 2050” roadmap, the IEA contemplates a 530 Mt H₂ worldwide consumption in 2050 (almost six times the 90 Mt H₂ consumed in 2020) and more than twice the “Announced Pledges Scenario” of 250 Mt H₂ by 2050 already “committed” by countries, with cumulative investments up to US$ 10 trillion by that year – on average, US$ 300 billion annually, or thrice the annual capital expenditure done by mining firms worldwide to sustain present operations and take on growth opportunities -, to make possible net zero CO₂ emissions by that year.

Hydrogen obtained from natural gas, at 75% of efficiency, approximately costs US$ 1 per kg in the US, Middle East and Russia, all main natural gas producers, with no carbon capture, storage and usage restrictions (CCSU). Given its 10 kg of CO₂ emission per H₂ kg produced, a US$ 100 per CO₂ ton would raise its cost to US$ 2 per kg.

Alternatively, hydrogen obtained from renewable energies – green hydrogen -, consuming electricity between 55 and 60 kWh to produce one kilogram of hydrogen with an energy content of 33 kWh – 55% efficiency -, would cost around US$ 1.5 per kg of H₂ assuming electricity costs close to US$ 10 per MWh. The sole energy cost would then amount to US$ 0.6 per kg of H₂. Renewable electricity costs will most probably approach US$ 10 per MWh and even lower in sun or wind privileged regions in the years ahead, but will hydrogen constitute the efficient medium to carry and store that energy and then take further energy losses in any additional conversion to meet potential end uses with 30% or less of the initial energy involved?

Continuing with the exercise, a US$ 100 per CO₂ ton, that would potentially enable green hydrogen to compete with fossil based hydrogen in the most favorable renewable energy regions, would also imply increasing the natural gas based electricity generation cost from around US$ 30 per MWh to US$ 70 per MWh – at 0.4 CO₂ ton per MWh -; increasing the coal based electricity generation from US$ 50 per MWh to US$ 150 per MWh – at 1 CO₂ ton per MWh -; and increasing diesel costs for transport from US$ 600 per m₃ to US$ 860 per m₃ – at 2.6 CO₂ ton per m₃ -. Remember Macron´s gilets jaunes?

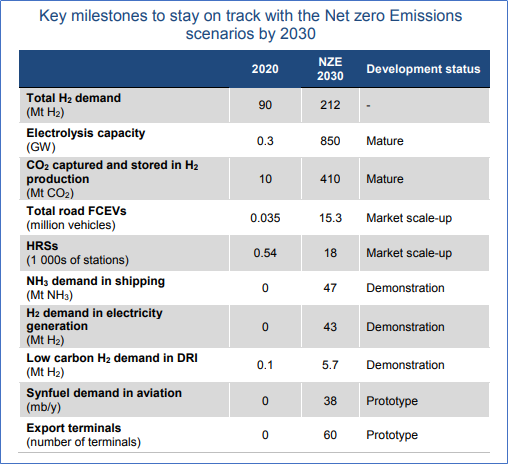

By 2030, IEA also stated that the world needed a 850 GW electrolysis capacity to produce green hydrogen, to comply with the “Net Zero by 2050” path. By 2020, it had a 290 MW electrolysis capacity, or 0.03% of an objective to be reached 10 years ahead. The 850 GW capacity would represent today 12% of world electric power capacity which totaled 7.071 GW in 2018, with 1.911 GW in China and 1.122 GW in the United States.

Then there would be mandates for blending natural gas with hydrogen – impossible beyond 20% of hydrogen for technical reasons, unless the whole transmission grid and end users change their equipment -, hydrogen pipelines, storage capacities, maritime transportation, port reception and end uses, all of which get further complicated due to the low volumetric energy density intrinsic to hydrogen – for example, ⅓ of natural gas -. The more steps are used, the higher CO₂ prices hydrogen would need to effectively compete with alternatives. Would world citizens then accept US$ 200 to US$ 500 per ton of CO₂, as some end uses require to close the cost gap, further increasing energy costs everywhere?

Moreover, hydrogen has already lost the battle against battery electric vehicles (BEV´s), a massive transformation taking place now in the transport industry from internal combustion vehicles, as BEV´´´s have dramatically reduced their costs. A one billion worldwide vehicle stock and 90 million new car sales per year are poised to be captured by BEV´s, with IEA´s remaining hope that some big trucks and buses could be hydrogen powered. The above means 70% of present oil demand will be gradually displaced by electric vehicles, based on their own cost advantages, and will ride under cleaner electricity grids again based on less expensive, by their own terms, renewable energies.

Any more issues? By year 2050, IEA foresees that 20% of global hydrogen demand would be internationally traded: however, let us not forget that it took 60 years to have a network of LNG liquefaction terminals (31) and receiving terminals (140) plus a shipping capacity to now represent approximately 13% of worldwide natural gas consumption. The first hydrogen carrier was delivered in 2020 and able to transport 75 tons of it, equivalent to the annual production from 1 MW electrolysis plant – these plants are supposed to reach a 850 GW capacity by 2030 -.

Lastly, it is useful to go over IEA´s 2030 objective and realize about the state of the art of hydrogen potential uses.

In summary, green hydrogen production costs, CO₂ per ton prices, production capacities to develop, huge investments, end uses to refine, extremely short time period to develop and worldwide coordination do not definitively match up.

Do we really believe consumers are going to accept very significant increases in their electricity, transportation and heating costs for the sake of world environment when above these cost considerations others do not make equivalent efforts? Do we understand that the biggest polluter in the world, China, consumes half the coal we use annually and that that will continue to be essential in its economy until fast advancing renewable energies gradually replace it? Do we imagine the second biggest natural gas producer (17% of world production), Russia, easily accepting a considerable upward adjustment in CO₂ ton prices when one third of Europe´s natural gas supply comes from there? Finally, can we conceive the biggest natural gas producer (24% of world production), the United States, quitting its obvious energy predominance in the short term in exchange for an uncertain and extremely difficult to coordinate path that, if implemented as IEA´s expects, would imply energy prices unheard of? Some politicians might wish for it, but citizens are definitely going to revolt to such a capricious policy with far, far away potential benefits.

“Back to school” for this “Net Zero to 2050” objective would be a fine advise. There needs to be better solutions, profiting from continuing decreases in renewables costs and BEV´s that by themselves are pushing out coal and oil – both fossil fuels represent 60% of world primary energy consumption at present times -. This particular proposed policy is completely out of bounds. Externalities do exist, as contamination attests, but if they are to be solved, a basic condition to comply with is that benefits have to outweigh costs, and notwithstanding its obviousness, be technically and politically feasible.

Scotland COP 26, UN Climate Change Conference, due November 2021, deserves much better.

Manuel Cruzat Valdés

October 16th, 2021