Dear Elon,

You might be interested in this strategic proposition. Who knows if in the near future we could reach an agreement as a country and celebrate it with a new SEC troublesome tweet.

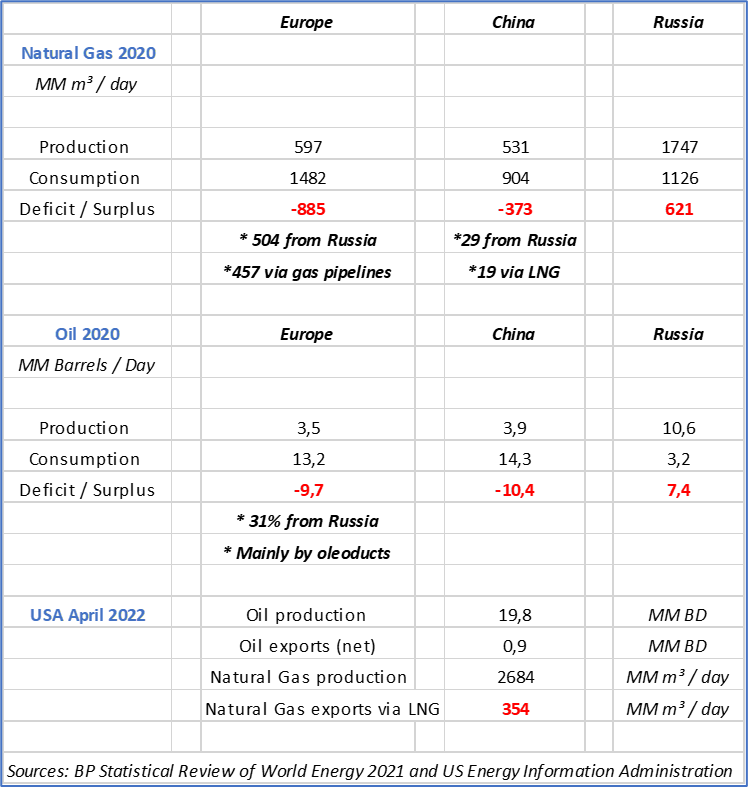

As you know, the Russian invasion over Ukraine has accelerated both the electromobility trend and a transition towards renewables, among other consequences. The next table is useful to understand it, particularly the pressure over Europe to get rid of a now uneasy Russian energy dependence via oil and gas pipelines, while at the same time nuclear energy was hindered or directly forbidden.

Even though China might “replace” Europe as a Russian energy client, it will take time and most probably will never reach the existing mutual energy dependency condition between Russia and Europe. You already have operations in Shanghai, but beware about your landlord over there. They are not subtle; they are not to be trusted under a dominant position. In contrast, the US might be energy hedged but remains being highly polarized. It is, as you might say, a challenging world.

And Tesla? At a production rate of 1.2 million vehicles per year as you got during this first quarter, you might need close to 100.000 metric tons of lithium carbonate (LCE). Last year 2021 global LCE production was near 500.000 metric tons. EV´s and LCE production races are definitely accelerating. Tesla was the primer.

And Chile? Salar de Atacama has two big lithium contracts out of its brine: SQM, which is increasing its production capacity to 180.000 metric tons of LCE in 2022 and whose contract expires in 2030; and Albemarle, which might reach an LCE production capacity of 85.000 metric tons this year and whose contract expires in 2045. Tianqi, the key to access China lithium processing and final consumers, owns 22% of SQM and simultaneously partners with Albemarle in Talison, Australia, whose Greenbushes spodumene development has a 134.000 metric ton LCE capacity. We are still waiting for a US Justice Antitrust Division to investigate these relationships and China´s role; do not waste your time before Chilean antitrust authorities. Besides, both contracts in Chile consider a royalty which goes from 6.8% at prices up to US$ 4.000 per LCE metric ton to 40% at prices over US$ 10.000 per LCE metric ton.

As of today, spot LCE prices hover around US$ 80.000 per metric ton. If an EV battery needs 0.8 kilograms per kWh, a 100 kWh battery would need 80 kilograms of LCE, valued at US$ 6.400, a cost a standard EV at a selling price of US$ 50.000 cannot afford. We all understand that, and more so when the objective is to massify EV´s at US$ 25.000, under bigger scales of production that could effectively deliver vehicles at this price at a profit.

Here is the opportunity: what can you offer our country in return for a, let us say, a supplying contract of 100.000 LCE metric tons, increasing over time? Would you have a Gigafactory plant in northern Chile? Would you have an EV plant in northern Chile from where to supply South America? Would you be interested in our clear skies to send satellites from the southern hemisphere? Would you develop solar cells?

Any new contract could be even parameterized on your businesses, as long term partners would do.

There is a world of opportunities in Chile, copper included.

But hold on, Elon, because we have to wait for a while: a new Constitution is being voted on next September 4th. As of now, the proposal has raised the specter of a populist mandate, the breach of a basic universal principle “one person – one vote”, with no checks and balances, with a non-unique judicial system overtly subject to executive influence and weakened property rights. Under those conditions, your investments would be highly precarious and the value of those potential contracts, negligible, even under new foreign investment protection treaties.

It is only after this proposed constitution is firmly rejected by Chileans and present and future governments move to the center, credibly divorcing from the radical left that has regrettably pushed a politically centered country into our present instability, that a business scenario could get serious and long term investments could then be advisable. Amendments to our present Constitution could always and have indeed historically been agreed upon, but on a rational basis condition, not on a condition where a minority is clearly attempting to found again this country from scratch under the not so delicate violence menace.

Patience will pay, to you and our country. Just be prepared to participate in it after an astounding majority yells from its profound heart to get back into normality, finally discarding this dangerous ideological power grab effort by a well organized minority.

This is our purgatory from which we will stand up again, but it gives you time to prepare for a long run adventure in our country which is now awakening from this nightmare.

Best regards and see you in September.

Manuel Cruzat Valdés

April 20th, 2022