Are the collapses of First Republic Bank, Signature Bank and Silicon Valley Bank the last ones in this economic cycle? Most probably, not. All of these failing banks had in common relevant losses – whether realized or not – related to abruptly higher interest rates in 2022, an unrelenting outgoing of deposits from the whole aggregate banking system for the last six months and the incoming negative consequences in activity from monetary aggregates falling now too far and too fast.

Surely, there were monetary and fiscal excesses that lasted longer than needed – at least one year -with the ensuing inflationary impact. But if one year ago tradable energy, food, metals and industrial commodities and maritime transportation costs pushed up the aggregate price level, now most of them are moving in the other direction, making easier monetary decisions. This welcome fact should be considered when dealing with past excesses so as not to exaggerate present policy readjustments.

US fiscal seriousness is urgently needed too: for the last six months ending March 2023 receipts went down by 2.9% to US$ 2 trillion and outlays went up by 13.2% to US$ 3.1 trillion with respect to previous year, delivering a US$ 1.1 trillion deficit difficult to dismiss when we are just considering the first half of this fiscal year. A US$ 26 trillion GDP to rely on is not infinite… To be fiscally credible and helpful with inflationary expectations, the worst the US could do now is to keep raising total public debt limits – now at US$ 31.5 trillion – with no intention to balance the budget but plainly monetize it, either through money or “unlimited” Treasury bond issuances that would carry their own devaluation – inflation – along time.

The following graphs should help to understand our common present challenge:

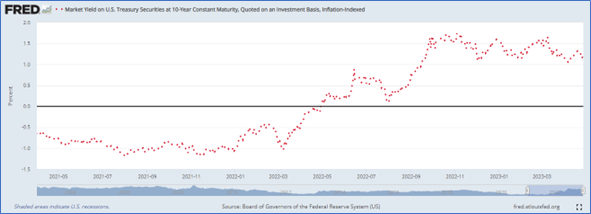

- A rapid rise of 200 basis points in real interest rates in 2022, as shown from market yields on 10 year US inflation indexed Treasury securities, could not be missed. For a ten year duration instrument at a fixed rate, that meant a 20% off value.

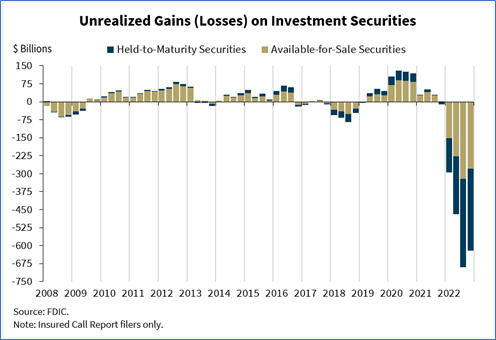

- As of December 31st, 2022, unrealized losses on investment securities from US commercial banks were US$ 620 billion. At that time, their total assets and liabilities were US$ 22.9 and US$ 20.7 trillion, respectively, leaving their aggregate equity at US$ 2.2 trillion. In other words, unrealized losses represented a sizable 28% of US commercial banks equity.

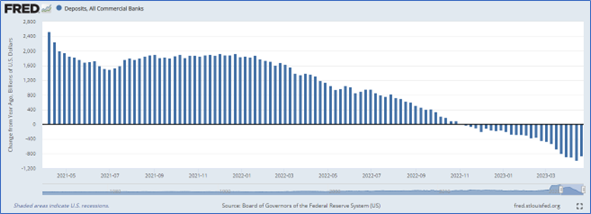

- Total deposits in commercial banks in the US peaked at US$ 18.2 trillion in April 2022; at present time they are at a US$ 17.2 trillion level. Their decrease started before Silicon Valley Bank and Signature Bank failures that took place last March. We have been facing a silent deposit withdrawal across the banking system that could accelerate at any time. Last March stress could just be a preamble if the delicate financial equilibrium is not soon credibly restored. A strong assumption indeed given present noises around.

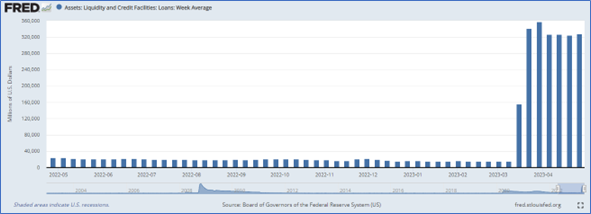

- To make possible this massive erosion in deposits, the Federal Reserve had to make emergency loans to banks that to this day represent over US$ 328 billion and which it has been unable to unwind yet.

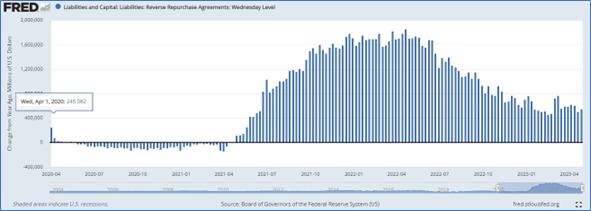

- Where has a significant portion of this liquidity from deposits taken out from the banking system gone into? You guess: back to the Federal Reserve, through Reverse Repurchase Agreements that now amount to US$ 2.6 trillion. It is much better for investors to have their money at the Federal Reserve than in the banking system. An ominous sign …

- And how about monetary aggregates, whose evolution should internalize interest rates movements and deposit withdrawals? M2 has been decreasing for the last four months with respect to the same months last year, having reached a negative annual growth rate of 4.1% last March.

- But was not M2 previously expanded beyond reasonable limits during the pandemic at annual rates over 25% and its downsizing therefore needed? That is right, but to go into the other contractionary extreme simply makes matters worse.

Even considering the huge expansion of M2 during the pandemic, its recent downward adjustment means that the trending real M2 since 2000 is just less than 3% the existing M2. In the coming months, given present policies and their own inertia, real M2 will soon be smaller than its long term trend value.

And that is where real activity will get hurt.

Inflationary pressures will recede, once excess liquidity is out – and that is the case right now -. Inflationary expectations have remained anchored in the range of 2 to 2.5% for over a year. In other words, inflation is not the problem, but late responses to it under a fragile banking system.

In some sense, the most probable scenario is one where present policymakers in the fiscal arena will overplay their unlimited financing for excessive outlays while in the monetary arena they will underplay the monetary aggregates contraction condition now in place so as to pretend to the general public having a hawkishness they clearly lacked before.

A downward pressure over the US dollar, already stressed under its close to 70% of GDP deficit in its international investment position, is warranted, and any further misstep in the banking system and its 4.706 banks by December 2022, which could easily happen given its delicate position, would fasten the emergence of a new short term equilibrium with a much weakened dollar and a financially dangerous recession.

What is amazing is that the market perception of volatility – as captured under the VIX index – is nowadays pretty low, at 16%, as if the party were not over yet. And that one is already over.

Manuel Cruzat Valdés

May 1st, 2023