In the year 2011 Quiñenco, a Chilean industrial and financial conglomerate, started investing in CSAV, a shipping company on the verge of bankruptcy. What initially started as a US$ 374 million investment ended up close to US$ 1.600 million by the end of the year 2014. It so happened that CSAV needed to be financially reinforced by successive capital increases of US$ 1.200 million, US$ 500 million and US$ 600 million in the years 2012, 2013 and 2014 respectively. Had it not been for them, CSAV would have probably gone bankrupt. Quiñenco today owns 42.44% of SM SAAM, a logistics firm born out of CSAV, and 55.22% of CSAV itself, whose main asset is a 34.01% equity participation in Hapag Lloyd, a container shipping firm that acquired CSAV container transport business in exchange for shares of the new company during the year 2014. At present market values, both investments done by Quiñenco add up to US$ 720 million[1], or about half the amount invested. In Quiñenco´s financial statements, they are valued, under the participation method to be applied in subsidiaries, at approximately US$ 2.250 million. Quiñenco has a US$ 3.4 billion market value.

No doubt it was a hard landing. But, will it ever be a business worthwhile the effort and resources involved in it? The case remains open, even considering that the hopefully complementary merger with Hapag Lloyd could have been a good first step to begin getting into safer seas and have more options to set the right business course. These possibilities were not available before when it was operating under too stressed financial conditions.

Hapag Lloyd is now undergoing a capital increase process, as described in its Prospectus[2]: 11.503.197 new shares to be offered under a price range from € 23 to € 29 per share. Existing shares before this capital increase total 104.882.240, which would value the equity of Hapag Lloyd between € 2.4 billion and € 3 billion before this capital increase. Given its present book value of € 44.44 per share, the price range would be between 52% and 65% of it. Its objective is to increase its fleet efficiency and container ownership, foster financial flexibility and support growth.

Hapag Lloyd owns (52%) or charters (48%) 188 ships, with a total transport capacity of 989.000 TEU or near 5% of a global containership fleet capacity that is currently approaching 21 million TEU – over 252 million DWT in 6.080 ships -. It is a member of the G6 Alliance (APL, Hapag Lloyd, Hyundai, NYK and OOCL), a shipping agreement that shares transport capacities among its members, involving 3.6 million TEU. Three other relevant alliances have also been born during these last years: 2M (Maersk and MSC, 5.5 million TEU), Ocean 3 (CMA CGM, CSCL and UASC, 2.8 million TEU) and CKYHE (Cosco, Kawasaki, Yang Min, Hanjin and Evergreen, 3.4 million TEU), trying to geographically service sea world routes while making a more efficient use of their container shipping capacities. Pricing decisions for their cargoes would be independent among alliance members but most probably checked under the competition authorities supervision in the US, EU and China, given a long standing and hard to end culture of price coordination under the famous old sea conferences.

World container traffic amounted to 66.8 million TEU in the year 2000, 134.5 million TEU in the year 2008, 139.2 in the year 2010 and 171.1 million TEU in the year 2014. Between the years 2000 and 2008 it annually grew by 9.1% – world GDP by 4.2% -; between the years 2010 and 2014, by 5.3% – world GDP by 3.6% -. In the year 2014, those 171.1 million TEU were distributed in 72.8 million TEU in East West traffic, 30.1 million TEU in North South traffic and 68.2 million TEU in Intra Regional traffic. In essence, growth rates going down in container traffic towards world GDP dynamics, themselves slowed down.

A particular characteristic of this container transport market has been its volatility related to lead times for new vessels that have been up to three years, thereby taking several years to correct for market imbalances, one way or the other.

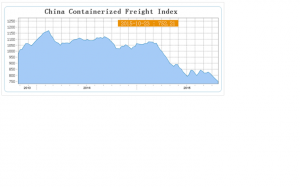

Freight rates are now at a historic low level. Parts of its explanation might lie with an oversupply of transport capacity, lowered oil prices, a more active competitive enforcement and more efficient shipping transport costs with bigger vessels and upgraded port facilities. Some are structural, some are cyclical. Which ones prevail for the next years is hard to ascertain but there is a real possibility that present price conditions could remain for a long time, as long as new and more efficient vessels get normal returns on their investment under competitive conditions. The following graph of shipping container rates for China is illustrative[3]:

As for the six months ending on June 30th, 2015 Hapag Lloyd had revenues of € 4.669 million, an operating result of € 258 million, a profit of € 157 million and an EBITDA of € 493 million, equivalent to 10.6% of total revenues. Its total assets amounted to € 10.824 million, its equity to € 4.681 million, its financial debt to € 3.953 million and its net financial debt to € 3.358 million. Noticeably, it had a negative working capital of € 432 million. Its explicit strategy is to get EBITDA margins between 11 and 12% of revenues. Marine or bunker fuel costs comprised 12% of revenue in the first six months of 2015, compared to 20.4% in the first six months of 2014 – or 21.2% in the year 2013 or 23.2% in the year 2012 -, following oil prices fall during the second half of last year from around US$ 100 per barrel to half of it. In terms of revenue, the Atlantic, Transpacific and LATAM trades explained 24%, 24% and 29% of its revenues. Finally, it is remarkable the assertion that “strong position in the flag protected cabotage services on the trade routes Chile Brazil, intra Chile and intra Peru, represent attractive niche businesses as due to flag restrictions other carriers are not able to offer these services”[4]. How nice would it be for economic authorities to understand the costs that societies bear in order to protect markets for reasons that go beyond efficiency?

In summary, corrective measures in CSAV have been already taken but that does not mean great values are to be recaptured from this venture, even assuming a good management at its subsidiaries. The real value – or lack of it – goes under structural market and technology definitions that could and should have been assessed before investing. As such and under present circumstances, the container transport market will probably remain competitive and its prices under downward pressure, making it more difficult to realize capital gains over these cumulative investments. It calls into attention the fact of how small a valuation for Hapag Lloyd business is finally due relative to its transportation effort and capacity approaching none other than 5% of worldwide container fleet transport capacity. As for CSAV and Quiñenco, at some time they will have to reckon with valuations far smaller than those shown in their financial statements and of those resources already invested, as in the mining sector has been occurring as of late. Such is business life. This one just went wrong, with only a slight probability to redeem itself.

Manuel Cruzat Valdés

October 29th, 2015

[1] 0.5522 x US$ 810 mm (CSAV) + 0.4244 x US$ 639 mm (SM SAAM), based on closing share values on October 27th, 2015

[2] Hapag Lloyd Prospectus for the public offering of 11.503.197 newly issued ordinary registered shares from a capital increase against cash contribution … October 14, 2015

[3] Shanghai Shipping Exchange, Freight Indices.

[4] Hapag Lloyd Prospectus, page 200.